2018-34: Revise Social Security Number Question in CCCApply

| Request No. | 2018-34 |

|---|---|

| Date of Request | July 25, 2018 |

| Requester | Steering; CCCApply Redesign Workgroup; |

| Application(s) | OpenCCC Account Creation, Edit Account, Recover Account |

| Section / Page | Page 1 |

| Steering Hearing Date | TBD |

| Proposed Change to Download File | Yes* |

| Change to Residency Logic | No |

| Jira | OPENAPPLY-6441 - Getting issue details... STATUS CCCFEDID-2338 - Getting issue details... STATUS |

August 16, 2019: Per email from Michael Quaioit, the SSN question must be implemented in the domestic version of the CCC application for admission (cite legal codes).

Problem / Issue

The Social Security Number question, that currently appears in the OpenCCC Account system, has long been known as a barrier for applicants; attributing factors include the overall layout design, the look & feel, the legal language, etc. The feedback received from students and colleges is that the legal language is overwhelming and the layout is confusing. Many students, including noncredit students, international students, undocumented, minors, etc, that do not have a SSN, are being forced to navigate through the legal information and penalties information - even though they are legitimate exceptions and are not required to have one or provide one. Although providing a SSN is optional, there are many reasons why students that have a SSN must provide it.

History Behind the Current Question

In 2014, colleges within the California Community Colleges were fined hundreds of thousands of dollars, each, because they were not providing SSNs for students, or they were providing bad numbers. The Chancellor's Office advocated for the colleges with the IRS and then released 1098-T Legal Opinion 13-05 which dictated the specific language that must appear on-screen in the application in September 2014.

Per IRS regulations, the SSN question must be implemented as an initial “statement” to all students and was required to include exactly what data is being collected, the purpose for collecting this data, and the consequences for not providing the data (penalties). In addition, State of California regulations required CCCApply to disclose what info needed to be collected for the CCCCO and why (shown in blue below).

In addition to the full disclosure statement and all other collection compliancy, Per Legal Opinion 13-05, CCCApply cannot “require” that students provide their SSN/TIN; likewise, per the exceptions, some students will not have the info to provide. This checkbox will alert page verification to pop up a reiteration of the “statement” and consequences per IRS requirements (SSN/TIN Encouragement).

Later in 2015, we added Taxpayer Identification Number to all the question labels and language, and "SSN Type" field was added to identify format. Validation checking will determine if the number is a TIN (begins with the number 9) or an SSN. OpenCCC Account Creation Data Dictionary will be revised to include new language, download values, etc

Proposed Design Drafts

Link to mock-up: https://xd.adobe.com/view/9a4384cf-dace-4baa-4c46-83ee0de6e393-ec72/?fullscreen

Proposed Solutions

Based on initial meeting discussion with CCC Foundation, Immigrants Rising, and CCCCO representatives, draft up another option or two - in addition to the main layout redesign (Option A) and test with students. The Foundation, Immigrants Rising and possibly CCGI - could all provide opportunities for student testing and feedback fairly quickly. Time is of the essence in order to meet the OpenCCC Redesign launch and CCCApply integration with that schedule.

Currently, CCCApply is working with the CCC Foundation on a design that incorporates all of the previously proposed layouts into a clickable, high-fidelity mock-up.

Please read about the mock-up:

- The mock-up is an Adobe XD export meant to represent and mimic the behaviors of a real website, it is not a real website.

- While the SSN question is currently in OpenCCC, not CCCApply, anticipating the integration roadmap this mock up shows SSN with anticipated placement in CCCApply (but could also be added to OpenCCC in the interim)

- The team only focused on the SSN section of the application — at this time.

- Not all links in the mock-up are live, just the options in the SSN section (pull downs, pop-up window, etc.)

(important note: to select “No” it is best to mouse around the “Yes” option; hit the Cancel button or Reload the page to simulate the optional behavior paths. This is a software limitation, not design)

Link to mock-up: https://xd.adobe.com/view/9a4384cf-dace-4baa-4c46-83ee0de6e393-ec72/?fullscreen

Historical Reference Information

These docs below provide some history around the layout and design of the legacy implementation:

Research Notes:

In reviewing the LEGAL information - there may be additional changes included to better serve our students.

- The noncredit application does not need to include the SSN - this has been requested by NOCE as well.

The International application may not need to include the SSN - this has been requested by LACCD several times.

- Instead of auto-population, for security purposes, if an applicant has already provided their SSN via OpenCCC account (associated to their CCCID) or Edit Account - do not display the question, but do pass the SSN data to the college from Student Profile via DLC, GLUE, or Report Center.

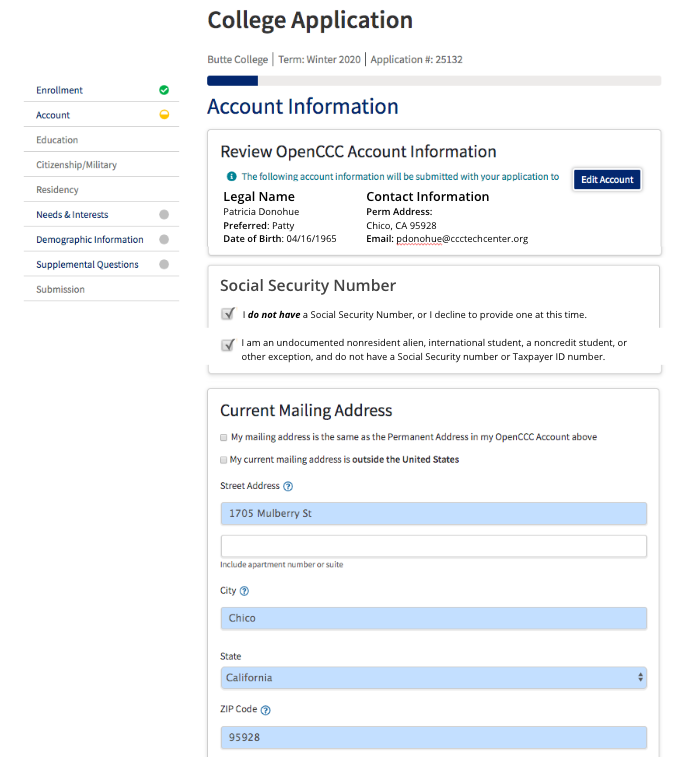

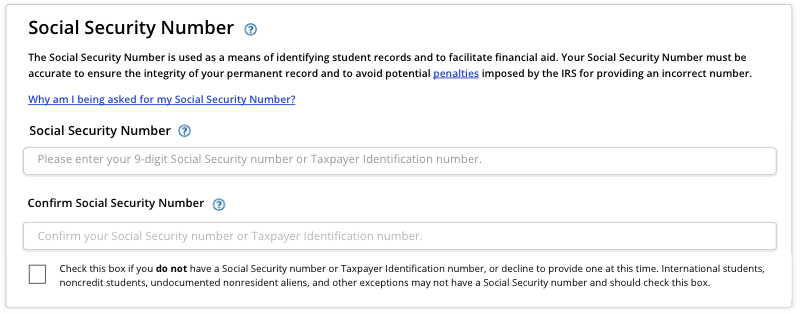

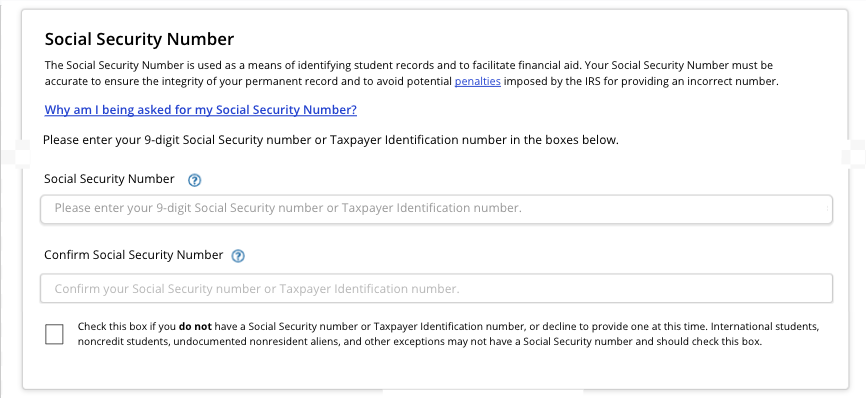

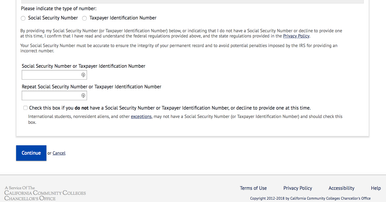

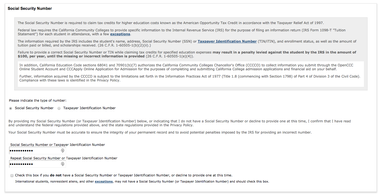

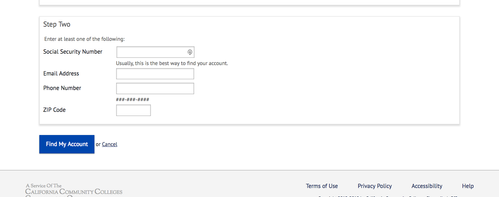

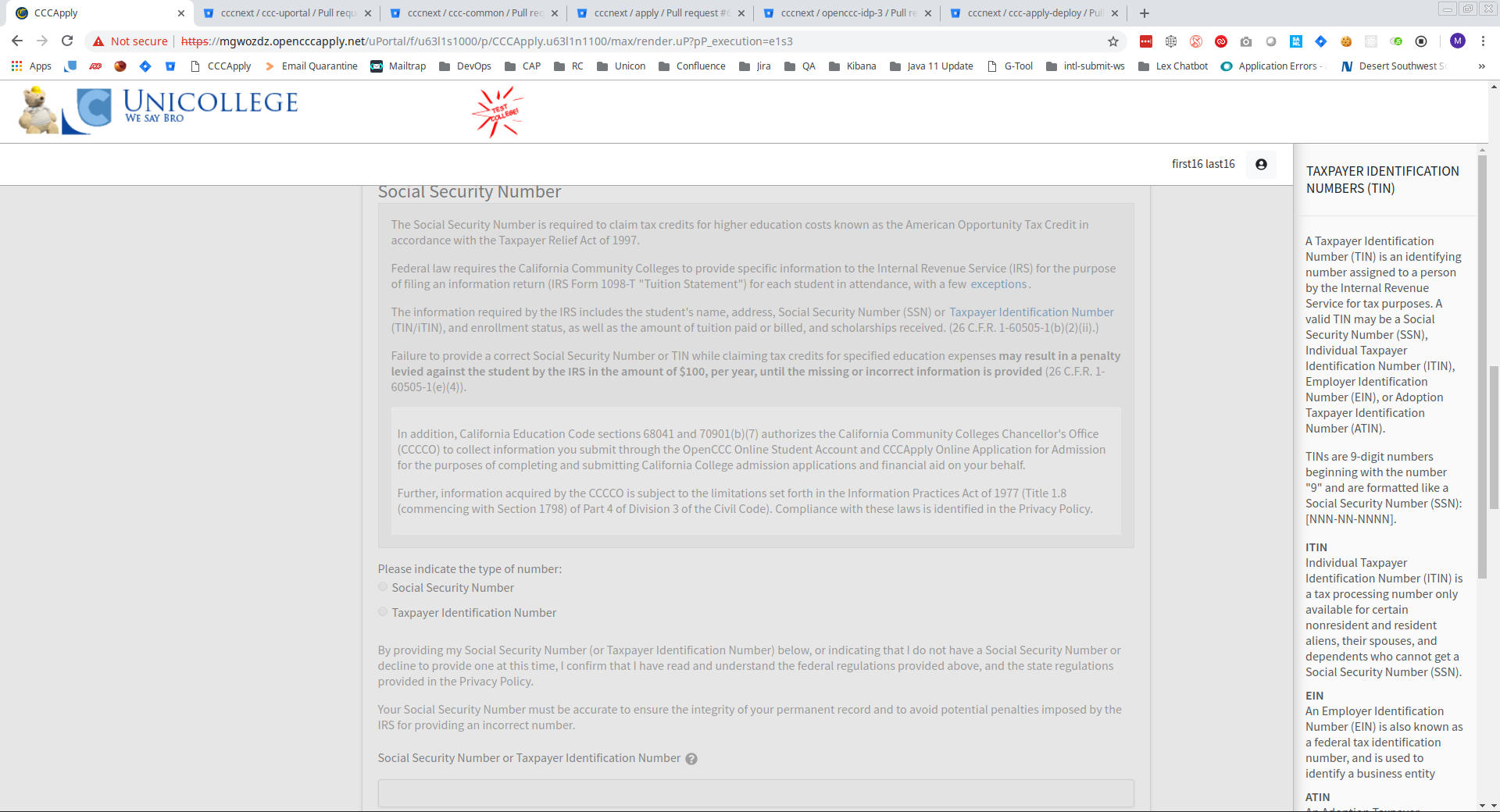

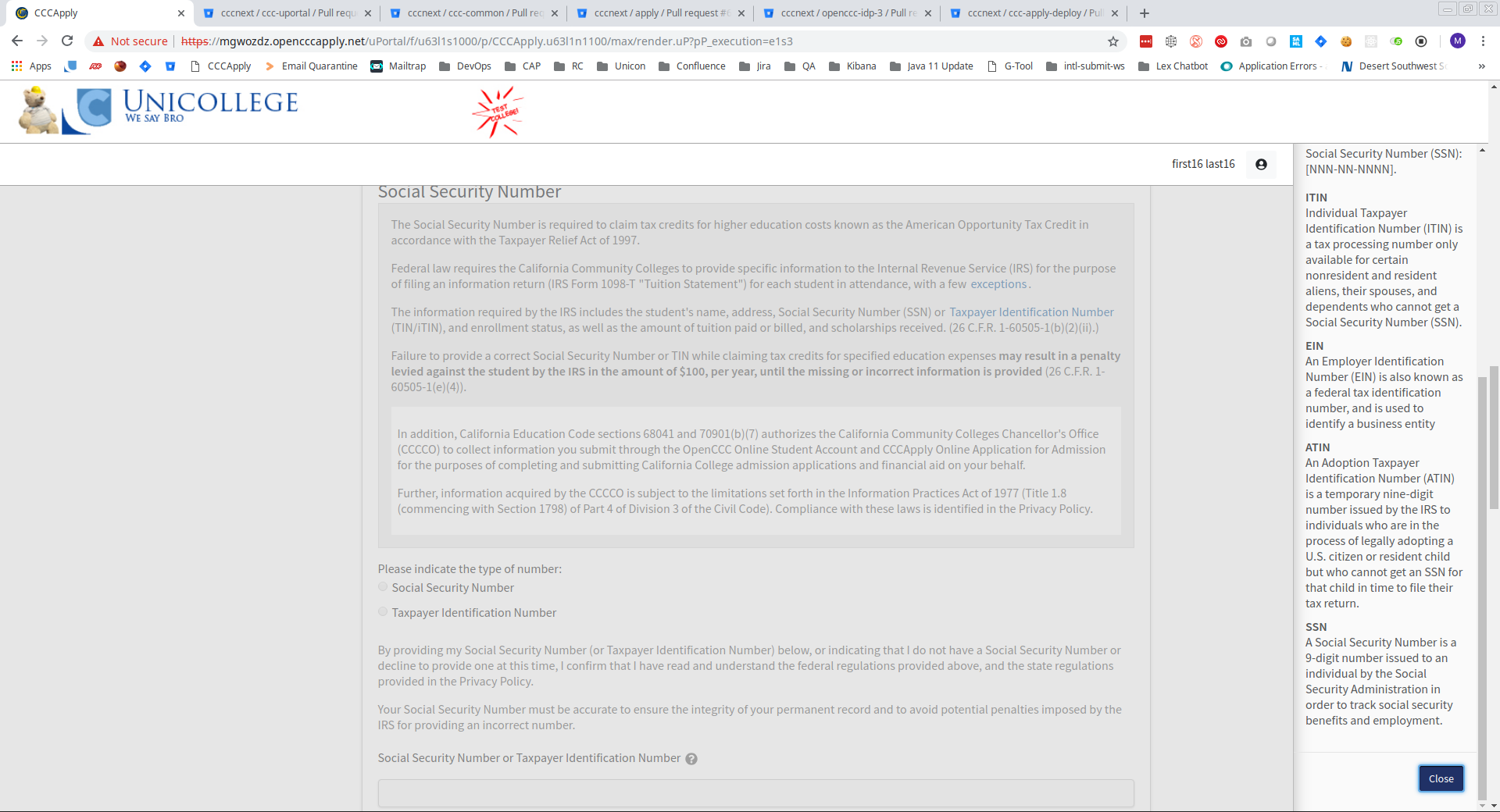

Pre-2020 SSN Question Language & Layout in OpenCCC

EXISTING SSN LAYOUT IN OPENCCC screenshots of the current (legacy) implementation

Internal Use: Requirements for Redesigning SSN / TIN in OpenCCC & Apply

Breakdown of Change Requirements

- Phase I: Revise the current SSN question in the OpenCCC Account (legacy) system, including the Edit Account system in CCCApply.

- Phase II: Remove the revised question from NEW OpenCCC system and move onto the CCCApply and place on the Account Information section of the Account Info/Mailing page.

- Implement a streamlined, shortened layout for collecting the Social Security number in the CCCApply Standard Application and display to all students. (Work with stakeholders to determine if SSN should appear in the Noncredit application, Promise Grant and International Applications, too.)

(see below) - See breakdown of requirements below.

Quick Specs: Social Security Number Revision

- Remove the current SSN question from the CCCApply Edit OpenCCC Account pages

- Implement the new SSN question layout - (Update OA-6441)

- Add legal language for SSN in the privacy policy - (pending approval)

- Add revised SSN to the Account Info page in Standard Application

- Do not display the SSN question in the Noncredit App workflow or the International Application. < pending approval.

REQUIREMENTS - New Layout from Foundation 11/26/19

# | Description | Solutions | JIRA |

|---|---|---|---|

| (Add requirements to make the SSN question changes itemized below - configured for mobile /responsive) | |||

| Remove the "I plan to apply for financial aid" checkbox from this question/layout. complete | Remove the "I plan to apply for financial aid" checkbox from this question/layout. | ||

| Revise question text and additional onscreen question text | Below the "Social Security Number" question label, the question text should read: The Social Security Number is used as a means for identifying student records and to facilitate federal financial aid. However, it is not required for admission." | ||

| Add new dropdown menu (new field or trigger) asking if the user has a SSN or TIN | Do you have a Social Security Number or Taxpayer Identification Number? Menu response options:

MODIFY No SSN field OR create new field (Josh is deciding) Validation If YES then display the SSN and Confirm SSN data input fields If NO is selected, THEN display - fill fill exist a If "I don't remember"...- THEN - display "Failure to provide..." box If "I decline to provide one..." THEN ...TBD | ||

| Add | |||

| Remove the SSN Type field <ssn_type> from the user interface, but keep the data field in the downloads and populate based on the existing logic (if SSN then populate the field with SSN; if TIN then populate the field with TIN) | Remove the SSN Type fields <ssn_type> from the user interface, but keep the existing logic around the number type and populate the field (for download and reporting). (Example, If the logic identifies that the number entered is a Social Security number vs. the Taxpayer ID number, populate the SSN Type field value accordingly). | ||

| ADD A NEW Help Text message under the hyperlink = "Why am I being asked for my Social Security Number?" | Add new hyperlink sentence under the question prompt text for the purpose of hiding (or moving) the majority of the required, legal language that is creating barriers for current applicants. Language in the hyperlink: "Why am I being asked for my Social Security Number? | NOTE: There is too much required language to put it all in one slider drawer (using the one new sentence proposed). Some of the required language will be split out and displayed using other hyperlinks. | |

| Keep both SSN and Confirm SSN input fields | Keep both SSN / Confirm SSN input fields. Add field logic to the SSN input field to determine if the number entered is a SSN or TIN. (NOTE: maintain existing field validation for SSN/TIN that currently exists today, including A) must have 9 numbers; B) if number starts with a 9, then it is a TIN; etc. Force formatting so that user inputs numbers (no letters, etc.) with hyphens, formatted correctly, etc. Ensure for att | ||

| |||

| Out-of-Scope: Redesign the SSN question to be a configurable question field (opt-in / opt-out) | This would require development in the Administrator | ||

Remove the language in red text and replace with the text in blue text. Remove all hyperlinks from within the text that's being moved into the slider drawer.

| "Why am I being asked for my Social Security Number?" The Social Security Number is required to claim tax credits for higher education costs known as the American Opportunity Tax Credit in accordance with the Taxpayer Relief Act of 1997. Federal law requires the California Community Colleges to provide specific information to the Internal Revenue Service (IRS) for the purpose of filing an information return (IRS Form 1098-T “Tuition Statement”) for each student in attendance, with a few exceptions. (few exceptions, including international students, undocumented nonresident aliens, and noncredit students.) The information required by the IRS includes the student’s name, address, Social Security Number (SSN) or Taxpayer Identification Number Taxpayer Identification Number (TIN/iTIN), and enrollment status, as well as the amount of tuition paid or billed, and scholarships received. (26 C.F.R. 1-60505-1(b)(2)(ii).) Failure to provide a correct Social Security Number or TIN while claiming tax credits for specified education expenses may result in a penalty levied against the student by the IRS in the amount of $100, per year, until the missing or incorrect information is provided In addition, California Education Code sections 68041 and 70901(b)(7) authorizes the California Community Colleges Chancellor’s Office (CCCCO) to collect information you submit through the OpenCCC Online Student Account and CCCApply Online Application for Admission for the purposes of completing and submitting California College admission applications and financial aid on your behalf. Further, information acquired by the CCCCO is subject to the limitations set forth in the Information Practices Act of 1977 (Title 1.8 (commencing with Section 1798) of Part 4 of Division 3 of the Civil Code). Compliance with these laws is identified in the Privacy Policy Privacy Policy. | (See CSU disclosure in the screenshot below: "pursuant to Section 41201, Title 5, Code of Regulations, and Section 6109 of the Internal Revenue Service... §301.6109-3 IRS adoption taxpayer identification numbers. (a) In general—(1) Definition. An IRS adoption taxpayer identification number (ATIN) is a temporary taxpayer identifying number assigned by the Internal Revenue Service (IRS) to a child (other than an alien individual as defined in §301.6109-1(d)(3)(i)) who has been placed, by an authorized placement agency, in the household of a prospective adoptive parent for legal adoption. An ATIN is assigned to the child upon application for use in connection with filing requirements under the Internal Revenue Code and the regulations thereunder. When an adoption becomes final, the adoptive parent must apply for a social security number for the child. After the social security number is assigned, that number, rather than the ATIN, must be used as the child's taxpayer identification number on all returns, statements, or other documents required under the Internal Revenue Code and the regulations thereunder. | |

KEEP the following Help text messages - using the existing hyperlinks. The Help text will display in right-side slider drawer instead of a pop-up error message. See mock-up for placement. with new or modified text | Keep: Privacy Policy - keep linking this out to the OpenCCC Privacy Policy | ||

| REMOVE | REMOVE: Exceptions: (keep existing hyperlink(s) and text boxes/language) REMOVE: Few exceptions (keep existing hyperlink(s) and text boxes/language) REMOVE: Taxpayer Identification Number (keep existing hyperlink(s) and text boxes/language) | ||

Add pop-up help box under a new hyperlink: "Why am I being asked for my Social Security Number?" Spell out definitions of TINs or get rid of it? Display the "few exceptions" on screen or get rid of hyperlink? | "Why am I being asked for my Social Security Number?" Pop-Up Help Box Hyperlink The Social Security Number is required to claim tax credits for higher education costs known as the American Opportunity Tax Credit in accordance with the Taxpayer Relief Act of 1997. Federal law requires the California Community Colleges to provide specific information to the Internal Revenue Service (IRS) for the purpose of filing an information return (IRS Form 1098-T “Tuition Statement”) for each student in attendance, with a few exceptions. The information required by the IRS includes the student’s name, address, Social Security Number (SSN) or Taxpayer Identification Number (TIN/iTIN), and enrollment status, as well as the amount of tuition paid or billed, and scholarships received. (26 C.F.R. 1-60505-1(b)(2)(ii).) Failure to provide a correct Social Security Number or TIN while claiming tax credits for specified education expenses may result in a penalty levied against the student by the IRS in the amount of $100, per year, until the missing or incorrect information is provided In addition, California Education Code sections 68041 and 70901(b)(7) authorizes the California Community Colleges Chancellor’s Office (CCCCO) to collect information you submit through the OpenCCC Online Student Account and CCCApply Online Application for Admission for the purposes of completing and submitting California College admission applications and financial aid on your behalf. Further, information acquired by the CCCCO is subject to the limitations set forth in the Information Practices Act of 1977 (Title 1.8 (commencing with Section 1798) of Part 4 of Division 3 of the Civil Code). Compliance with these laws is identified in the Privacy Policy. | (See CSU disclosure in the screenshot below: "pursuant to Section 41201, Title 5, Code of Regulations, and Section 6109 of the Internal Revenue Service... §301.6109-3 IRS adoption taxpayer identification numbers. (a) In general—(1) Definition. An IRS adoption taxpayer identification number (ATIN) is a temporary taxpayer identifying number assigned by the Internal Revenue Service (IRS) to a child (other than an alien individual as defined in §301.6109-1(d)(3)(i)) who has been placed, by an authorized placement agency, in the household of a prospective adoptive parent for legal adoption. An ATIN is assigned to the child upon application for use in connection with filing requirements under the Internal Revenue Code and the regulations thereunder. When an adoption becomes final, the adoptive parent must apply for a social security number for the child. After the social security number is assigned, that number, rather than the ATIN, must be used as the child's taxpayer identification number on all returns, statements, or other documents required under the Internal Revenue Code and the regulations thereunder. | |

| Exceptions Exceptions include students exclusively enrolled in noncredit courses, undocumented international students and nonresident aliens, unless the nonresident alien student requests that a return be provided to the IRS. (26 C.F.R. 1.60505-1(a)(2), (b)(5)(ii).) | ||

| Keep existing | ||

Keep the existing link out to the Privacy Policy (OpenCCC) | Keep existing but check that it's pointing to the correct doc. | ||

|

| no longer valid | |

|

| no longer valid |

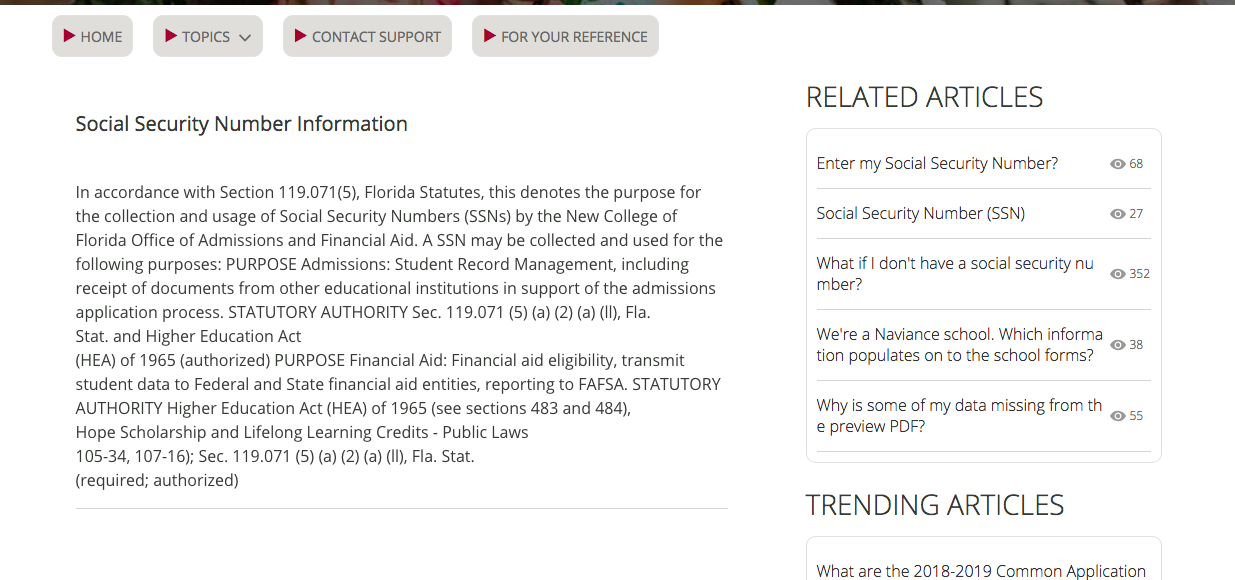

SSN in the Common Application

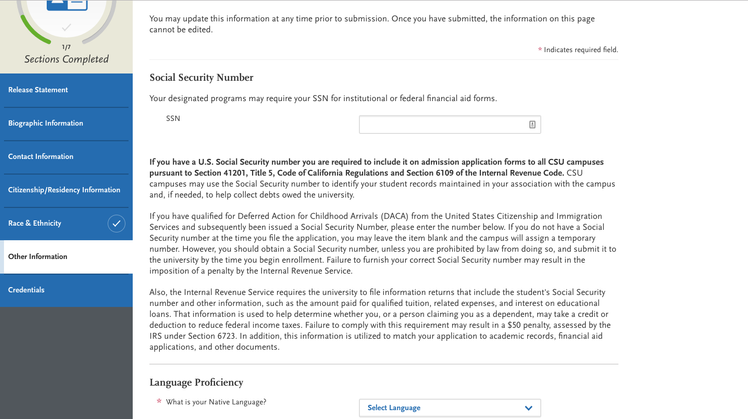

SSN in the CSU Apply

Notes

One more thing on this...on a phone or tablet, you won't see the second scrollbar for the notification because browsers for phones and tablets hide scrollbars. I'm not sure if that would be considered a plus or a minus, but that's how it'll be. It will still be scrollable though

.

Supporting Documentation

NEW Social Security Number language.CCCCO.Final.doc

ssn specifications excerpt ammedits 22515(3).doc

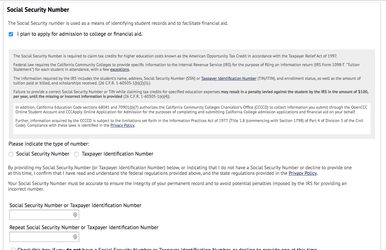

CURRENT Spec Details

Name | Data Field | Format | Question Text |

|---|---|---|---|

Label & Question | Prompt Text | Social Security Number (or Taxpayer ID Number) The Social Security Number is used as a means of identifying student records and to facilitate financial aid. | |

Financial Aid Interest | <fin_aid> | Checkbox |

|

IRS Legal Language | Prompt Text | The Social Security Number is required to claim tax credits for higher education costs known as the American Opportunity Tax Credit in accordance with the Taxpayer Relief Act of 1997. Federal law requires the California Community Colleges to provide specific information to the Internal Revenue Service (IRS) for the purpose of filing an information return (IRS Form 1098-T “Tuition Statement”) for each student in attendance, with a few exceptions. The information required by the IRS includes the student’s name, address, Social Security Number (SSN) or Taxpayer Identification Number (TIN/iTIN), and enrollment status, as well as the amount of tuition paid or billed, and scholarships received. (26 C.F.R. 1-60505-1(b)(2)(ii).) Failure to provide a correct Social Security Number or TIN while claiming tax credits for specified education expenses may result in a penalty levied against the student by the IRS in the amount of $100, per year, until the missing or incorrect information is provided In addition, California Education Code sections 68041 and 70901(b)(7) authorizes the California Community Colleges Chancellor’s Office (CCCCO) to collect information you submit through the OpenCCC Online Student Account and CCCApply Online Application for Admission for the purposes of completing and submitting California College admission applications and financial aid on your behalf. Further, information acquired by the CCCCO is subject to the limitations set forth in the Information Practices Act of 1977 (Title 1.8 (commencing with Section 1798) of Part 4 of Division 3 of the Civil Code). Compliance with these laws is identified in the Privacy Policy. | |

Help Boxes | hyperlink | Pop-Up Hyperlink | A Few Exceptions: Exceptions include students exclusively enrolled in noncredit courses, undocumented international students and nonresident aliens, unless the nonresident alien student requests that a return be provided to the IRS. (26 C.F.R. 1.60505-1(a)(2), (b)(5)(ii).) Taxpayer Identification Number: Privacy Policy: Hyperlink to the existing Privacy Policy. Opens in a new page Other Exceptions |

SSN Type | <ssn_type> | Radio Buttons | Please indicate the type of number:

|

SSN / Confirm SSN | <ssn> | Text Input | By providing my Social Security Number (or Taxpayer Identification Number) below, or indicating that I do not have a Social Security Number or decline to provide one at this time, I confirm that I have read and understand the federal regulations provided above, and the state regulations provided in the privacy policy. Your Social Security Number must be accurate to ensure the integrity of your permanent record and to avoid potential penalties imposed by the IRS for providing an incorrect number. Social Security Number (or Taxpayer Identification Number) Repeat Social Security Number (or Taxpayer Identification Number) (This statement ensured we are complying with regulations by having students “confirm” they have read and understand exactly what data is being collected and why, and the consequences for not complying with federal regulations. By wording the confirmation statement in this way, we were also removing the need for another download field.) |

Decline to State | <no_ssn> | Checkbox |

|

International Exception | <ssn_exception> | Checkbox |

|

For Internal Use Only

Related JIRAs |

|---|

| CCCFEDID-2338 - Getting issue details... STATUS |