| Request No. | 2018-34 | ||||||||||||||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

| Date of Request | July 25, 2018 | ||||||||||||||||||||||||

| Requester | Steering; CCCApply Redesign Workgroup; | ||||||||||||||||||||||||

| Application(s) | OpenCCC Account Creation, Edit Account, Recover Account | ||||||||||||||||||||||||

| Section / Page | Page 1 | ||||||||||||||||||||||||

| Steering Hearing Date | TBD | ||||||||||||||||||||||||

| Proposed Change to Download File | Yes* | ||||||||||||||||||||||||

| Change to Residency Logic | No | ||||||||||||||||||||||||

| Jira |

|

| Table of Contents |

|---|

Problem / Issue

The current Social Security Number question in the OpenCCC Account has long been known as a barrier for applicants; attributing factors include the overall layout design, the look & feel, the legal jargon, etc. The feedback received from students and colleges is that the question is intrusive. Many students, including noncredit students, international students, minors, etc, don't have an SSN, or if they do have one, they don't know the number. Furthermore, the layout is confusing, and NOT user-friendly. Though the question is optional, there are many state, federal and local reasons why we need students to provide their SSN.

In 2014, the IRS fined the California Community Colleges hundreds of thousands of dollars due to incorrect or missing SSNs for thousands of students. . The Chancellor's Office worked with the IRS and then released Legal Opinion 13-05 (see attached) which dictates the language and layout specifications which CCCApply implemented in September 2014.

- Per IRS regulations, the SSN question must be implemented as an initial “statement” to all students and was required to include exactly what data is being collected, the purpose for collecting this data, and the consequences for not providing the data (penalties). In addition, State of California regulations required CCCApply to disclose what info needed to be collected for the CCCCO and why (shown in blue below).

- In addition to the full disclosure statement and all other collection compliancy, Per Legal Opinion 13-05, CCCApply cannot “require” that students provide their SSN/TIN; likewise, per the exceptions, some students will not have the info to provide. This checkbox will alert page verification to pop up a reiteration of the “statement” and consequences per IRS requirements (SSN/TIN Encouragement).

Later in 2015, we added Taxpayer Identification Number to all the question labels and language, and "SSN Type" field was added to identify format. Validation checking will determine if the number is a TIN (begins with the number 9) or an SSN. OpenCCC Account Creation Data Dictionary will be revised to include new language, download values, etc.

| Note |

|---|

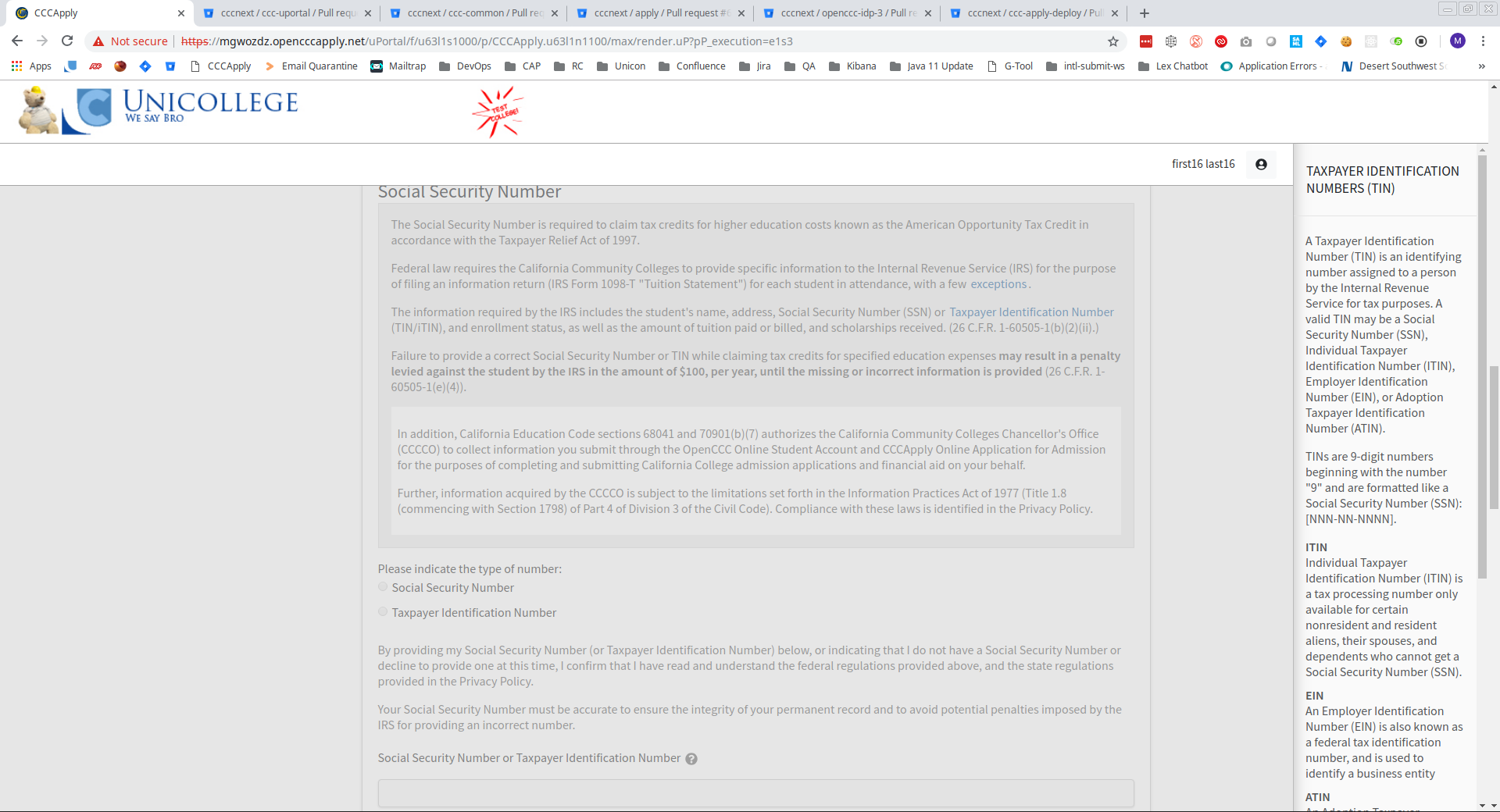

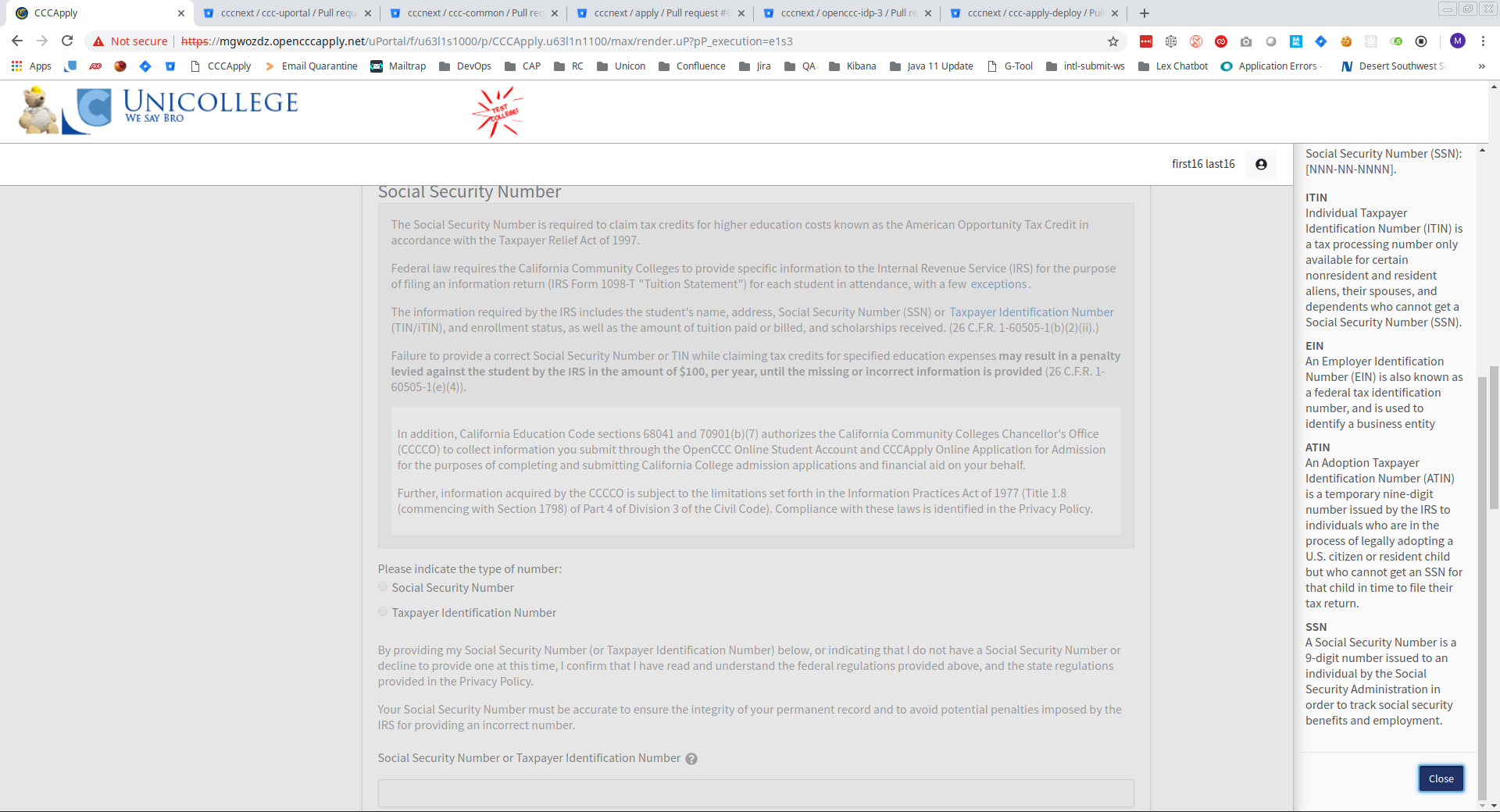

Current SSN Question & Layout

Click here to see screenshots of the current (legacy) implementation

| Expand |

|---|

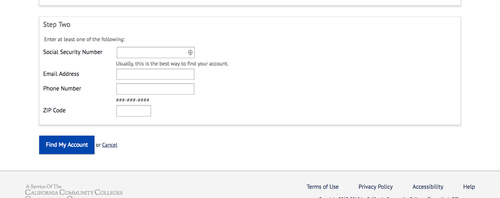

SSN in Account Recovery |

Historical Reference Information

These docs below provide some history around the layout and design of the legacy implementation:

- 13-05 1098 Penalties.doc

- NEW Social Security Number language.CCCCO.Final.doc

- ssn specifications excerpt ammedits 22515(3).doc

- 2014-02 Revise SSN TIN Question on Application.doc

CURRENT Spec Details

| Name | Data Field | Format | Question Text |

|---|---|---|---|

| Label & Question | Prompt Text | Social Security Number (or Taxpayer ID Number) The Social Security Number is used as a means of identifying student records and to facilitate financial aid. | |

| Financial Aid Interest | <fin_aid> | Checkbox |

|

| IRS Legal Language | Prompt Text | The Social Security Number is required to claim tax credits for higher education costs known as the American Opportunity Tax Credit in accordance with the Taxpayer Relief Act of 1997. Federal law requires the California Community Colleges to provide specific information to the Internal Revenue Service (IRS) for the purpose of filing an information return (IRS Form 1098-T “Tuition Statement”) for each student in attendance, with a few exceptions. The information required by the IRS includes the student’s name, address, Social Security Number (SSN) or Taxpayer Identification Number (TIN/iTIN), and enrollment status, as well as the amount of tuition paid or billed, and scholarships received. (26 C.F.R. 1-60505-1(b)(2)(ii).) Failure to provide a correct Social Security Number or TIN while claiming tax credits for specified education expenses may result in a penalty levied against the student by the IRS in the amount of $100, per year, until the missing or incorrect information is provided In addition, California Education Code sections 68041 and 70901(b)(7) authorizes the California Community Colleges Chancellor’s Office (CCCCO) to collect information you submit through the OpenCCC Online Student Account and CCCApply Online Application for Admission for the purposes of completing and submitting California College admission applications and financial aid on your behalf. Further, information acquired by the CCCCO is subject to the limitations set forth in the Information Practices Act of 1977 (Title 1.8 (commencing with Section 1798) of Part 4 of Division 3 of the Civil Code). Compliance with these laws is identified in the Privacy Policy. | |

| Help Boxes | hyperlink | Pop-Up Hyperlink | A Few Exceptions: Exceptions include students exclusively enrolled in noncredit courses, undocumented international students and nonresident aliens, unless the nonresident alien student requests that a return be provided to the IRS. (26 C.F.R. 1.60505-1(a)(2), (b)(5)(ii).) Taxpayer Identification Number: Privacy Policy: Hyperlink to the existing Privacy Policy. Opens in a new page Other Exceptions |

| SSN Type | <ssn_type> | Radio Buttons | Please indicate the type of number:

|

SSN / Confirm SSN | <ssn> | Text Input | By providing my Social Security Number (or Taxpayer Identification Number) below, or indicating that I do not have a Social Security Number or decline to provide one at this time, I confirm that I have read and understand the federal regulations provided above, and the state regulations provided in the privacy policy. Your Social Security Number must be accurate to ensure the integrity of your permanent record and to avoid potential penalties imposed by the IRS for providing an incorrect number. Social Security Number (or Taxpayer Identification Number) Repeat Social Security Number (or Taxpayer Identification Number) (This statement ensured we are complying with regulations by having students “confirm” they have read and understand exactly what data is being collected and why, and the consequences for not complying with federal regulations. By wording the confirmation statement in this way, we were also removing the need for another download field.) |

| Decline to State | <no_ssn> | Checkbox |

|

| International Exception | <ssn_exception> | Checkbox |

|

Proposed Solution & Change Specifications

Breakdown of Change Requirements

# | Description | Solutions | Notes | ||||||||||||

|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|---|

Revise the overall layout, look & feel, question text, hyperlink pop-up boxes, etc., of the Social Security Number question to: |

|

| |||||||||||||

Add pop-up help box under a new hyperlink: "Why am I being asked for my Social Security Number?" | "Why am I being asked for my Social Security Number?" Pop-Up Help Box Hyperlink The Social Security Number is required to claim tax credits for higher education costs known as the American Opportunity Tax Credit in accordance with the Taxpayer Relief Act of 1997. Federal law requires the California Community Colleges to provide specific information to the Internal Revenue Service (IRS) for the purpose of filing an information return (IRS Form 1098-T “Tuition Statement”) for each student in attendance, with a few exceptions. The information required by the IRS includes the student’s name, address, Social Security Number (SSN) or Taxpayer Identification Number (TIN/iTIN), and enrollment status, as well as the amount of tuition paid or billed, and scholarships received. (26 C.F.R. 1-60505-1(b)(2)(ii).) Failure to provide a correct Social Security Number or TIN while claiming tax credits for specified education expenses may result in a penalty levied against the student by the IRS in the amount of $100, per year, until the missing or incorrect information is provided In addition, California Education Code sections 68041 and 70901(b)(7) authorizes the California Community Colleges Chancellor’s Office (CCCCO) to collect information you submit through the OpenCCC Online Student Account and CCCApply Online Application for Admission for the purposes of completing and submitting California College admission applications and financial aid on your behalf. Further, information acquired by the CCCCO is subject to the limitations set forth in the Information Practices Act of 1977 (Title 1.8 (commencing with Section 1798) of Part 4 of Division 3 of the Civil Code). Compliance with these laws is identified in the Privacy Policy. | (See CSU disclosure in the screenshot below: "pursuant to Section 41201, Title 5, Code of Regulations, and Section 6109 of the Internal Revenue Service... | |||||||||||||

Keep the pop-up Help textbox and hyperlink for "Exceptions" in the "SSN Exceptions" checkbox | Exceptions Exceptions include students exclusively enrolled in noncredit courses, undocumented international students and nonresident aliens, unless the nonresident alien student requests that a return be provided to the IRS. (26 C.F.R. 1.60505-1(a)(2), (b)(5)(ii).) | ||||||||||||||

Keep the pop-up Help text box and hyperlink for "Taxpayer Identification Number" - keep all existing | Keep existing | ||||||||||||||

Keep the existing link out to the Privacy Policy (OpenCCC) | Keep existing but check that it's pointing to the correct doc. | ||||||||||||||

| |||||||||||||||

Update Account Matching logic to reduce duplicates for Account & proxy Account Account Matching OPTION A | Currently our duplication rate is .003 and we need to protect that number What can be done to remove reliance on SSN? Account Creation, Matching & Verification Specification v5.4.0 | ||||||||||||||

Account Matching Redesign SSN Question | Keep in OpenCCC Account for now Remove the SSN Encouragement pop-up Consider: Why am I being asked for my SSN? See Patty's version of revision to the language in our existing Account app here: /wiki/spaces/PD/pages/729514134 | SSN Original Specs: |

Notes

/wiki/spaces/OPENAPPLY/pages/72155240

/wiki/spaces/CCCFEDID/pages/2916466

/wiki/spaces/CCCFEDID/pages/3866651

Requirements for Redesigning SSN / TIN in OpenCCC & Apply

IRS_MissingTIN_p1586.pdfNEW Social Security Number language.CCCCO.Final.doc

Notes regarding "mobile support" conversion work - in-progress now for Apply, Promise, IA:

Notes regarding "mobile support" conversion work - in-progress now for Apply, Promise, IA:

One more thing on this...on a phone or tablet, you won't see the second scrollbar for the notification because browsers for phones and tablets hide scrollbars. I'm not sure if that would be considered a plus or a minus, but that's how it'll be. It will still be scrollable though

.

Supporting Documentation

| View file | ||||

|---|---|---|---|---|

|

| View file | ||||

|---|---|---|---|---|

|

For Internal Use Only

Related JIRAs | ||||||||

|---|---|---|---|---|---|---|---|---|

|

2019

2019 Current Information regarding Move to Account and Layout Revision

Tim Calhoon |

Jul 2, 2019, 11:53 AM

---------- Forwarded message ---------

From: Tim Calhoon <calhoonti@cccnext.net>

Date: Mon, Nov 4, 2013 at 6:17 AM

Subject: Fwd: Proposed Wording for SSN / TIN Specification

To: Tasks <timcalhoon.168605@toodledo.com>

From: "Patricia Donohue" <donohuepa@cccnext.net>

Date: Nov 3, 2013 11:30 PM

Subject: Proposed Wording for SSN / TIN Specification

To: "Terry McCune" <mccunete@cccnext.net>, "Tim Calhoon" <calhoonti@cccnext.net>

Cc:

Tim and Terry,

I have review documents, requirements and IRS code for the SSN / TIN change request. Based on the discussion/requirements outlined by the Steering Committee, I have drafted some proposed text, layout and stronger language (on screen layout, error messages, warnings, pop-up Help).

I think that I am on the right track and hope this helps the solution specification. Can we have a phone discussion to review this proposition?

I have a more detailed spec solution draft attached. I included an outline of:

a) What we need to collect and how;

b) What are the requirements;

c) What are the penalties and how do we act in a responsible manner to protect colleges/system.

<< Proposed Text based

Social Security Number / Tax Identification Number

Pursuant to Internal Revenue Service (IRS) Code 6050S andI plan to apply for admission to college or financial aid.

Additionally, this information may be provided to the Chancellor's Office of the California Community Colleges for the purposes of evaluating, auditing, and improving state education programs under California Law (Chapter 1458, stats. 1985).Your information is protected by secure transmission and by the provisions of the Privacy Policy.

Please enter your Social Security Number / Tax Identification Number

Repeat Social Security Number / Tax Identification Number

Please indicate the type of number:

Social Security Number (SSN)

Tax Identification Number (TIN)

Individual Taxpayer Identification Number (I-TIN)Check this box if you do not have a Social Security number or Tax Identification number. How to get a SSN or TIN?

Check this box if the name that appears on your Social Security card / Tax Identification card is different than your legal name above.

Enter the name that appears on your current Social Security card or Tax identification card.

The attached spec draft shows the beginning of conditional questions, new data fields, logic, etc.Strong Language – Pop Up Message

You Must Provide Your Social Security Number / Tax Identification NumberPursuant to the Internal Revenue Code (IRC) 6050S and 6051, the California Community Colleges are required to solicit, and students are required to provide Social Security Numbers / Tax Identification Numbers. Failure to provide your Social Security Number / Tax Identification Number

The IRS can levy penalties on the student for refusing to provide a SSN / TIN while claiming tax credits for specified education expenses incurred by the taxpayer, the taxpayer’s spouse, or the taxpayer’s dependent.

Tax Credits - Providing your SSN / TIN is required to apply for the Hope Scholarship Tax Credit and Lifelong Learning Credit in accordance with the Taxpayer Relief Act of 1997. (26 U.S.C. § 25A(b)Financial Aid - Your SSN / TIN number is required to apply for financial aid, including student and federal aid, and the BOG fee waiver.Availability of Records - The California Community Colleges also use Social Security Numbers / Tax Identification Numbers to verify enrollment, degree(s) and transcripts, administer financial aid, collect student debt, and conduct research. Your information will only be utilized in a manner that does not permit personal identification of you.How to get an SSN or ITINTo apply for an SSN, use Form SS-5, Application for a Social Security Card, that you can get from your local Social Security Administration office. To apply for an ITIN because you are not eligible to get an SSN, use Form W-7, Application for IRS Individual Taxpayer Identification Number, retrievable from the IRS by calling 1-800-TAX-FORM (1-800-829-3676) or from the IRS website at www.irs.gov.

I have read this warning and I understand the following: (to be determined)

Dependencies, Risks and/or Reporting Requirements?

Question | Yes | No | Which data field(s)? | What/How? |

|---|---|---|---|---|

| Would this change affect an existing question or data field on the Standard Application? | ||||

| Would this change affect an existing question or data field on the International Application? | ||||

| Would this change affect an existing question or data field on the Promise Grant Application? | ||||

| Would Account (OpenCCC) data be affected by this change? | ||||

| Does the question or data field align to an MIS reporting requirement now? | ||||

Does this change affect any other state or federal regulations or requirements? | ||||

| Would this change affect existing residency logic? | ||||

| Would any other data fields be affected by this change? | ||||

| Would students users be affected by this change? | ||||

| Would colleges be affected by this change? | ||||

| Would the Download Client be affected by this change? | ||||

| What other tech center web services will be affected by this change? | i.e., Glue staging table? Multiple Measur | |||

| Other dependencies? | ||||

| Other implementation considerations? |